Table of Contents

The routing number for Bank of America in California is 121000358

The routing number for Bank of America in California is 121000358. The bank has 51 routing numbers (one for each state) so make sure your target state for payment or transfer is California. Continue reading to know more about what is a routing number and how to use it for wire transfers.

Bank of America has different routing numbers for different states and transaction types. For example, the routing number for checking and savings accounts in California is 121000358, while the routing number for domestic wire transfers is 026009593.

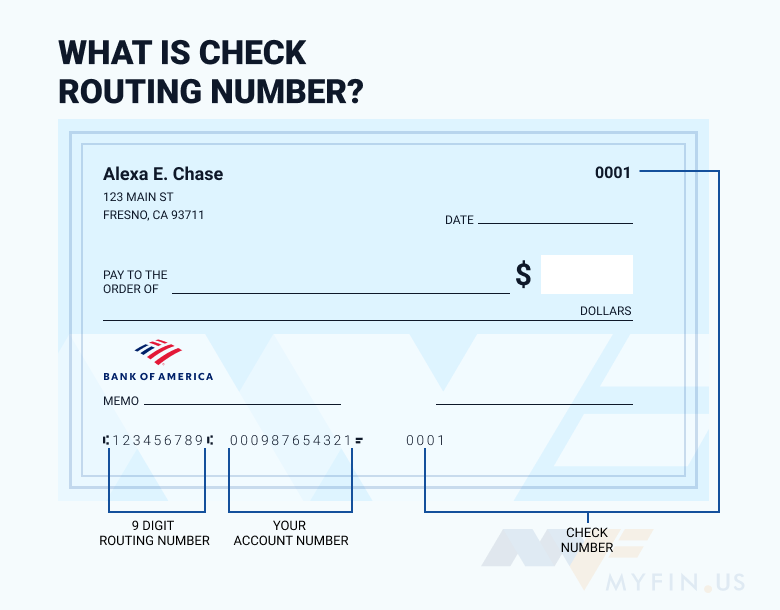

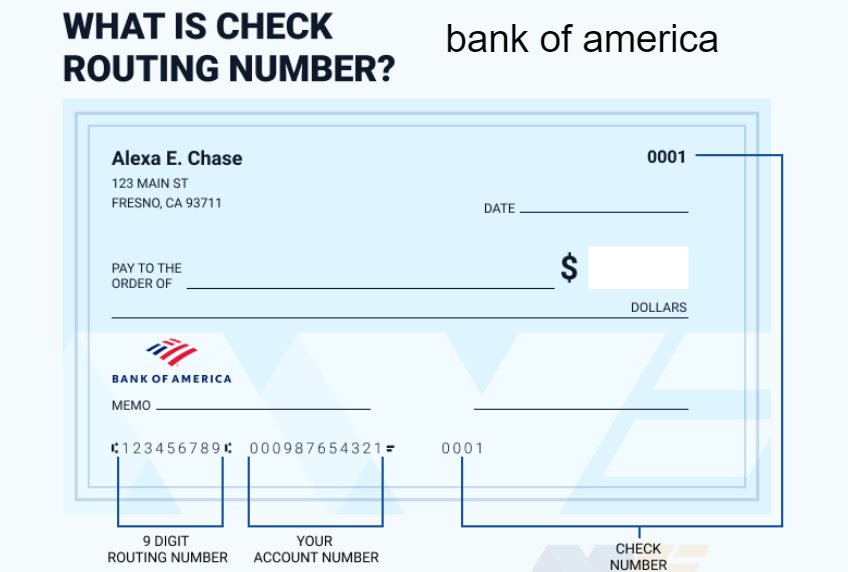

You can find your routing number in several places:

- On the bottom left corner of your checks

- In your online banking or mobile app

- On a bank statement

If you need to find your routing number for an international wire transfer, you will also need the SWIFT code for Bank of America. The SWIFT code is a unique identifier for international financial transactions. The SWIFT code for Bank of America is SALAMA33.

Here is a table for different states and transaction types:

| Transaction Type | State | Routing Number |

| Checking and savings accounts | California | 121000358 |

| Checking and savings accounts | Florida | 63100277 |

| Checking and savings accounts | New York | 26000003 |

| Domestic wire transfers | All states | 26009593 |

| International wire transfers | All states | SALAMA33 |

Which routing number {121000358} should I use Bank of America?

You should use the routing number 026009593 for Bank of America. Bank of America has a single Wire Routing Number for both domestic and international wire transfers. You can find this routing number on your Bank of America checks, bank statements, or online banking.

You will also need to provide the recipient’s account number and SWIFT code to initiate a wire transfer. The SWIFT code for Bank of America is BOFAUS3N for incoming wires in U.S. dollars and BOFAUS6S for incoming wires in foreign currency.

What is Bank of America’s ACH Routing Number?

BOA ACH routing number depends on the state in which your account was opened. However, the ACH routing number for domestic wire transfers is 026009593. This routing number can be used for ACH transfers, such as direct deposit or automatic bill payments.

Bank of America Routing Number on a Check

You can find your BOA check Routing Number in the bottom left corner. It is a nine-digit number that is printed below your account number and check number.

Is the Bank of America routing number the same?

Yes, the Bank of America routing number is 026009593 the same.

Read More

MidFirst Bank – Routing Number

Why Is It Useful To Have Your Bank Account And Routing Numbers When Using Tax Preparation Software?

Using Duty medication software to file your levies can be a more effective and systematized way to manage your duty liabilities.

When using similar software, having your bank account and routing figures is useful for

Direct Deposit for Refunds If you’re entitled to a duty refund, entering your bank account and routing figures allows you to admit your refund directly into your bank account. This system is generally faster than entering a paper check in the correspondence. Direct deposit is also more secure as there’s lower threat of a check being lost or stolen.

Payment of levies Owed If you owe plutocrat to the IRS or your state duty agency, numerous duty medication software results allow you to make direct electronic payments. To do this, you’d need your bank account and routing figures to draft the payment directly from your account. This can be more accessible than posting a check, and you can generally admit evidence that your payment has been entered.

Electronic Filing Verification Some duty agencies bear bank account or routing figures as a system of vindicating your identity when electronically filing your duty return. This is a fresh measure to ensure the security and integrity of electronic duty forms.

Automatic Savings or Investment Some advanced duty medication software might offer options to automatically allocate portions of your refund to savings or investment accounts. Having your bank account and routing figures ready can ease this process.

Avoid crimes Homemade processes, similar to writing checks or transcribing bank details, are prone to crimes. By using your bank account and routing figures directly within duty medication software, you minimize the chances of making a mistake.

Record Keeping Using electronic styles for both payment and damage of finances makes it easier to maintain accurate and timely fiscal records. You’ll have a clear digital trail of all deals related to your levies.