Table of Contents

How to Use Webull app?

Certainly! Let’s dive into how to use Webull, a popular online trading platform. Whether you’re a seasoned trader or a beginner, understanding the basics of Webull can help you trade more effectively. Here’s a step-by-step guide:

- Account Setup and Deposit:

- No Minimum Deposit: Webull doesn’t require a minimum deposit, so you can start trading with any amount.

- Deposit Options:

- Make Your First Deposit: If you’re new to the platform, tap the middle icon at the bottom of the screen and choose “Make Your First Deposit.”

- Transfer: If you’ve already set up your account or want to transfer from another broker, select the “Transfer” option.

- Payment Methods:

- ACH (Automated Clearing House): Free for most users. Confirm details by logging into your base bank account.

- Wire Transfer: For US and international customers, but associated with admin charges.

- Account Verification:

- Choose between Real-Time Verification (faster) or Micro-Deposit Verification (takes 1-2 days).

- Select your bank from the list or use the search function to link it.

- Confirm the deposit amount and complete the payment.

- Keep an eye out for the ‘Free Stock Offer’ promotion.

- Trading and Investing:

- Explore the Webull app interface:

- Real-time stock quotes, charts, and news.

- Paper Trading: Practice without real money.

- Watchlists and Alerts.

- Place Orders:

- Market Orders: Buy or sell at the current market price.

- Limit Orders: Set a specific price for execution.

- Stop Orders: Triggered when the stock reaches a certain price.

- Research Tools:

- Stock Screener: Filter stocks based on criteria.

- Financial Calendar: Stay informed about earnings reports, dividends, and economic events.

- News and Analysis: Access relevant news articles and expert opinions.

- Explore the Webull app interface:

- Withdrawal:

- To initiate an ACH withdrawal:

- Go to the homepage of the mobile app and tap the Webull logo.

- Click on the ‘Transfers’ tab and select ‘Withdraw’.

- Enter the withdrawal amount and follow the prompts.

- To initiate an ACH withdrawal:

Remember, understanding the platform thoroughly can enhance your trading experience. Feel free to explore Webull’s features and take advantage of the tools available to you! 📈🚀

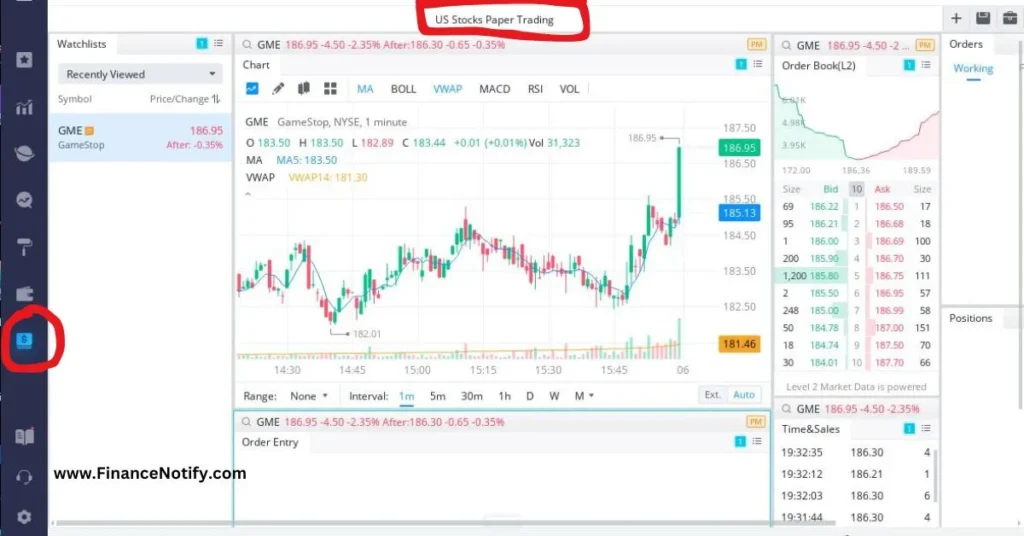

How to Use Webull Paper Trading

Certainly! Let’s explore how to use Webull Paper Trading, a valuable feature that allows you to practice trading without risking real capital. Whether you’re a beginner or an experienced trader, Webull’s paper trading can help you hone your skills and gain confidence. If you have some queries like: how to use webull desktop? how to use webull mobile app? These Topics are covered. Here’s a step-by-step guide:

- Accessing Webull Paper Trading:

- Desktop/Web:

- Log in to your Webull account on the desktop or web platform.

- Look for the “Menu” tab and find “paperTrade” under “Shortcuts.”

- Click on “Trade” to start exploring tickers you’re interested in.

- Enter the details page for a specific stock and tap “paper trade” at the bottom.

- Fill in the virtual order details (quantity, price, etc.) and submit.

- Manage your positions and open orders from the main Paper Trading screen.

- Mobile App:

- Open the Webull mobile app.

- Tap the middle icon at the bottom of the screen.

- Choose “Paper Trading” to access the virtual trading environment.

- Explore real-time quotes, charts, and indicators.

- Practice trading strategies without any risk to your actual funds.

- Desktop/Web:

- Features of Webull Paper Trading:

- Zero Risk:

- Use the free trading simulator to practice risk-free and commission-free.

- Unlimited Virtual Cash:

- Trade as many paper trading dollars as you want.

- Real-Time Data:

- Access real-time stock quotes, explore integrated charts, and set up price alerts.

- Test New Strategies:

- Experiment with different trading approaches to see what works.

- Indicator Studies:

- Apply over 50 technical indicators and 12 charting tools to your charts.

- Zero Risk:

- Remember:

- Webull Paper Trading is a great way to learn and gain experience.

- It’s especially useful if you:

- Want to try trading stocks but don’t have enough funds yet.

- Have capital to trade but aren’t sure where to begin.

- Need a virtual environment to test new strategies.

So go ahead, explore Webull Paper Trading, perfect your trading skills, and build confidence before diving into live trading! 📈🚀

F&Qs: How to Use Webull App for Beginners

Can I trade cryptocurrencies on Webull?

Certainly! Webull offers real-time cryptocurrency trading, allowing you to invest in various digital assets. Here’s what you need to know:

- Available Cryptocurrencies:

- You can trade 36 cryptocurrencies against the US dollar on Webull.

- Some popular options include:

- Bitcoin (BTC)

- Ethereum (ETH)

- DogeCoin (DOGE)

- Shiba Inu (SHIB)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

- USD Coin (USDC)

- Fees and Costs:

- Webull charges a 1.5% fee built into the spread for crypto trading. Be sure to consider this when calculating your overall trading costs.

- Platform Access:

- You can access crypto trading via the Webull app or the desktop platform.

- Explore real-time prices, charts, and market data to make informed decisions.

Remember that all investments involve risk, and it’s essential to stay informed and make well-thought-out choices. Happy trading! 🚀🌟

How do I contact customer support?

Certainly! If you need assistance with Webull, you have a few options to contact their customer support:

- Phone Support:

- You can call Webull’s customer service phone number at 1-888-828-0618.

- Their customer service hours are from Monday to Friday, 8 am to 6 pm (Eastern Time).

- Email:

- General Hotline (Singapore):

- You may contact Webull via the general hotline at +65 6013 3322 if you’re in Singapore.

- The hotline is open from Monday, 09:00 SGT to Saturday, 08:00 SGT (during EDT) or 09:00 SGT (during EST).

What are the fees for trading on Webull?

Webull offers transparent and straightforward prices with 0 commission trades for stocks, ETFs, and most options listed on U.S. exchanges. However, there are a few important points to note:

- Stocks and ETFs:

- Commission-Free: You can trade stocks and ETFs without paying any commissions.

- Certain Index Options: While most options are commission-free, there is a $0.55 per contract fee for certain index options trades.

- Regulatory and Exchange Fees: Relevant regulatory and exchange fees apply to all trades.

- Margin Trading:

- If you engage in margin trading (using borrowed funds), you’ll be charged margin interest if you hold the position overnight.

- The margin rate varies based on the size of the margin loan.

- Other Fees:

- Short Selling Fees: When shorting a stock, you’ll need to borrow shares, and there’s a fee associated with borrowing those shares.

- Fees Charged by Regulatory Agencies & Exchanges: These fees include SEC regulatory transaction fees, FINRA regulatory fees, and options exchange fees. Webull does not profit from these fees; they are passed through to clients.

Remember to stay informed about the costs associated with trading and make well-informed decisions. Happy trading!

Related Posts:

- how to buy Ethereum on Etoro

- options trading on Etoro

- how to buy dogecoin on Etoro

- how to buy Bitcoin on Etoro

[…] How to Use Webull […]